This week, one trade one win only. Slow start. Hopefully next month Nov, will have more courage for more trades.

Wednesday, Oct 26

-1 1504

+1 1499

Points: 4

Profit/(loss) ~ RM200

Capital : RM7,150 + 639 (rebate hlf)

Total capital : RM7789

Notes: Today's trade was nerve wrecking, I short fkli way too early despite telling myself be patient n wait. Got my que at 1504, knew the price was not good, true enough headed to 1508.5. By right, I would have stop loss at 1507. But based on the SS line it was above the 90 line I held on. Phew!, if it had gone any higher, then i would have been another case study now.. LOL. Lucky, it turned out with money in the pocket.

Be conservative. Be humble. Keep your feet on the ground and your head out of the clouds. Have respect for trading and it will respect you.

Wednesday, October 27, 2010

Saturday, October 23, 2010

Selecting a Trading Approach

Fundamental Analysis: Trying to PREDICT the market. I have given up on this it just does not work. Fundamentals don't make sense to me ANYMORE. It's not the news that moves the market – it's the reaction

of the traders to the news that makes the prices jump up and down

Technical Analysis : REACTING to the market. Using a technical approach, you don’t have to twist your mind to come up with an explanation for why the market behaves as it does.

You simply believe that the factors which affect price – including fundamental, political, and psychological factors – have all been built into the price you see.

“A picture speaks a thousand words.” This proverb holds just as true for charts.

of the traders to the news that makes the prices jump up and down

Technical Analysis : REACTING to the market. Using a technical approach, you don’t have to twist your mind to come up with an explanation for why the market behaves as it does.

You simply believe that the factors which affect price – including fundamental, political, and psychological factors – have all been built into the price you see.

“A picture speaks a thousand words.” This proverb holds just as true for charts.

Saturday, October 16, 2010

MyJournal** wk 3

** Was busy on Monday & Tuesday. Hence, no trades on these days.

October 21, Thursday

Sure felt like a complete loser today. Was so certain that the price for fkli was going to hit high and its too heavy, but I was determine to get the best price and at the end landed up nothing. Lost another winning trade. Placed a que at -1 1498 (fabulous) price. Then canceled when i saw klci gaining momentum upwards. If had held on to the que would have got it and made some.. time move one again.

October 20, Wednesday

3.00pm ~ Today was a complete mistake, failed to make full use of the opportunity with the MA lines. Instead, I took a que -1 1486 based on the SS, which the lines was showing its a 50-50 chance, but the MA lines had already made a cross and heading upwards. Oh Gosh!! What was I doing? When a trade does not look right, dont hesitate, luckly I acted fast enough to cancel the order. What a waste... That's for not following the rules.

3.00pm ~ Today was a complete mistake, failed to make full use of the opportunity with the MA lines. Instead, I took a que -1 1486 based on the SS, which the lines was showing its a 50-50 chance, but the MA lines had already made a cross and heading upwards. Oh Gosh!! What was I doing? When a trade does not look right, dont hesitate, luckly I acted fast enough to cancel the order. What a waste... That's for not following the rules.

October 21, Thursday

Sure felt like a complete loser today. Was so certain that the price for fkli was going to hit high and its too heavy, but I was determine to get the best price and at the end landed up nothing. Lost another winning trade. Placed a que at -1 1498 (fabulous) price. Then canceled when i saw klci gaining momentum upwards. If had held on to the que would have got it and made some.. time move one again.

October 20, Wednesday

3.00pm ~ Today was a complete mistake, failed to make full use of the opportunity with the MA lines. Instead, I took a que -1 1486 based on the SS, which the lines was showing its a 50-50 chance, but the MA lines had already made a cross and heading upwards. Oh Gosh!! What was I doing? When a trade does not look right, dont hesitate, luckly I acted fast enough to cancel the order. What a waste... That's for not following the rules.

3.00pm ~ Today was a complete mistake, failed to make full use of the opportunity with the MA lines. Instead, I took a que -1 1486 based on the SS, which the lines was showing its a 50-50 chance, but the MA lines had already made a cross and heading upwards. Oh Gosh!! What was I doing? When a trade does not look right, dont hesitate, luckly I acted fast enough to cancel the order. What a waste... That's for not following the rules.

Journey to Freedom

There are no secrets to trading success. It's the extra mile that we walk in every trade and the extra degree we add to every success. No one will be profitable all the time. No strategy will be conservative all the time. And there is none called expert in the markets. Markets can humble anyone, anytime.

I hope with this experience I am able to glide with the wind, weather any rain and storm and when to just stop or maneuver.

I hope with this experience I am able to glide with the wind, weather any rain and storm and when to just stop or maneuver.

Saturday, October 9, 2010

MyJournal ** wk 2

*not much results seen here.

*Thursday Oct 14

-1 1496

+1 1492.5

Points: 2.5

Profit/(loss) ~ RM125

Capital : RM6,950

Monday Oct 11

-1 1488.5

+1 1491.5

Points: -4

Profit/(Loss) ~ (RM200)

Capital : RM6,825

CL triggered, PT set 1484

did not follow signal

Monday, October 4, 2010

MyJournal ** wk 1

Notes : I need to re-evaluate my risk point of entry, looking at the weeks trade I am being too careful. Careful is good but careful without results needs more homework. Before, on virtual trades it was easy cause there was no money management emotion involved but after going live, different cerita pulak.

Thank God, did not get my short last Friday. Dow closed green so likely fkli is going to move higher than 1481 on Monday.

October 08, Friday

Placed a que to short at 1482 then changed it to 1481 thereafter. I held on steady to que position till closed. Was all prepared to take the risk through the weekend. But sometimes things just dont work out as planned especially in futures. The price came so close, stopped at 1480 and just dropped back. Too bad.

October 06, Wednesday

FKLI opened 1483, interesting, hard for me to swallow, time to move on, and try again.

What you have said kept playing on my mind, "If you are not able to control your emotions, this is not the place for you". I am trying, just dunno how.... :(

October 05, Tuesday

+1 1469 (signal)

-1 1469.5

Profit :-0.5

Profit/Loss: (RM25)

Capital : RM7,025

(i panic when saw the price dropped, signal still showing uptrend) (right after i closed the order it went to 1476. Sad.) So frustrated with myself.

notes: Today's mistake was i did not set a stop loss for this trade, my CL point was manually set at 1466. Knowing emotions will set in, i should have put in a stop loss with my broker to cut away all the unnecessary panic and would hv probably saved my trade today.

October 04, Monday

I was watching fkli today whole day, trading around 1478 from 11am it was trading sideways. First signal came in at 3pm the drop was so fast i was not able to get my que which was at 1476.5 short. Usually I would not take the risk till the second signal pops up. By the time the second signal was seen the price has dropped way too low 1472. Too bad have to miss this... and wait for another sunrise.

There were a few doubts, I had during this trade one of which was the magic at close. Don't want to be caught holding short. It is sure not easy to pull the trigger...

Oh darn klci at 5pm is trading at 1665. Magic did a show down.

Fkli closed at 1464.5

MOVE ON!!

notes: must take the 15x into consideration for entry.

Thank God, did not get my short last Friday. Dow closed green so likely fkli is going to move higher than 1481 on Monday.

October 08, Friday

Placed a que to short at 1482 then changed it to 1481 thereafter. I held on steady to que position till closed. Was all prepared to take the risk through the weekend. But sometimes things just dont work out as planned especially in futures. The price came so close, stopped at 1480 and just dropped back. Too bad.

October 06, Wednesday

FKLI opened 1483, interesting, hard for me to swallow, time to move on, and try again.

What you have said kept playing on my mind, "If you are not able to control your emotions, this is not the place for you". I am trying, just dunno how.... :(

October 05, Tuesday

+1 1469 (signal)

-1 1469.5

Profit :-0.5

Profit/Loss: (RM25)

Capital : RM7,025

(i panic when saw the price dropped, signal still showing uptrend) (right after i closed the order it went to 1476. Sad.) So frustrated with myself.

notes: Today's mistake was i did not set a stop loss for this trade, my CL point was manually set at 1466. Knowing emotions will set in, i should have put in a stop loss with my broker to cut away all the unnecessary panic and would hv probably saved my trade today.

October 04, Monday

I was watching fkli today whole day, trading around 1478 from 11am it was trading sideways. First signal came in at 3pm the drop was so fast i was not able to get my que which was at 1476.5 short. Usually I would not take the risk till the second signal pops up. By the time the second signal was seen the price has dropped way too low 1472. Too bad have to miss this... and wait for another sunrise.

There were a few doubts, I had during this trade one of which was the magic at close. Don't want to be caught holding short. It is sure not easy to pull the trigger...

Oh darn klci at 5pm is trading at 1665. Magic did a show down.

Fkli closed at 1464.5

MOVE ON!!

notes: must take the 15x into consideration for entry.

Sunday, October 3, 2010

Will support hold or fail? Price rejection can usually tell the tale…

One of the most important questions in trading is “will the support/resistance level hold or fail?” (One of the other very important questions is “is this market trending or in a trading range”, but these are really the same question because trends repeatedly break support/resistance and support/resistance holds in trading ranges.) Many traders do not realize that there are some very characteristic price actions associated with levels holding or breaking, and, more often than not, it is possible to tell in advance what is likely to happen around a level.The key element of price action in a support level (I will write this blog dealing specifically with support, but everything applies equally well to resistance) is price rejection at the level. Simply put, as the market comes down to the level, buyers immediately step up and push the market away from the level. It feels (and it is not inappropriate to talk about subjective feelings in these discussions) like the market does not want to be at the level and there is a move away from the level very quickly.

On the other hand, if the market is able to go quiet and dull at support, there is a much higher probability of the level failing. The fact that the market is able to trade at or near (whether slightly above or below) support usually presages the level breaking and price trading through.

A few other points to consider: Words like “soon” and “immediately” must be taken in context of the timeframe, which is why some traders prefer to think in “bars”. If the level is an important multi-year level, price may well do work around the level for many weeks in a successful test. On the other hand, tests of highs and lows of the previous day in individual stocks usually see price rejection within 5-10 minutes if they are going to hold cleanly. Second, anything can happen in the market at any time. Never think that something will happen or something has to happen, because the best we can do as traders or analysts it to define the most probable outcome. Even if we are very good, and are working with a very high probability pattern, we will be right maybe 60% of the time (and often far less), so that still leaves a significant percentage of the time that these patterns do not work as expected. All that matters is you understand the edge and what will happen over a very large sample of trades, and then make sure you are aligning your trades with the probabilities.

Lastly, these patterns are most useful if you own them and make them your own. I have trained traders in the past and one of the exercises I had them do was literally to find several hundred examples of support / resistance both holding and failing on daily charts, and then to examine price action on intraday charts around those levels. You really do have to see many hundreds of patterns before you are comfortable with all the variations of holding and failing (and then failures of failures). I do not believe it is constructive, or even possible, to catalog all of the possible variations, but intuition will slowly grow from repeated exposure. Be aware that there is a tremendous difference between understanding patterns and trading, and this is but one of many important elements of price action.

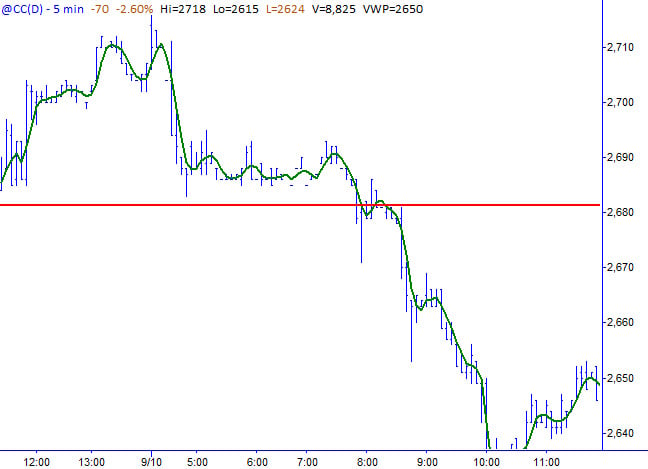

Let’s look at how this played out in the Cocoa futures market this past week. (Yes, I have deliberately picked a market that will be somewhat esoteric to many of my readers, but these concepts apply without loss of generality to any market and any timeframe.) Biiger picture (not visible on the small chart), Cocoa has been in a downtrend after dropping below important support, consolidating lower and extending into another trend leg down. The last downtrend ended on the last day of August (the first blue-bodied candle on the chart below) with an outside bar that defined support and resistance for the next two weeks. We had several successful tests of resistance marked A on the chart below. (Note that this is a different type of test where the level was penetrated but held on the close of the bar. In many ways, this is a more meaningful test than a clean test.) I was expecting that support would break and the market would trade lower, but one day held cleanly to the tick (marked B), and the next dropped support (C). Let’s look at B and C in detail:

Here we can see the price action on the day marked B on the daily chart, which shows clear price rejection at the level. I have added a very short-term moving average (a 3 period moving average using (H+L+C)/3 as the price point for the average) as a tool to help outline the price action. I would not suggest using a short-term average like this in actual trading, but it is a good tool to help the eye see the overall trend of prices. In fact, it is useful to examine the action of a short-term average like this around many different support/resistance levels as a tool for learning. At any rate, we do see a textbook example of price rejection here as the level holds.

At C, we see a completely different type of price action. First of all, we should have been on alert because price “should not” have been back at the level the next day if it was going to hold. A successful test with price rejection like we had the day before should have led to a series of higher lows as buyers held the market above the level. The next day, we are back at the level and now price goes dull and quiet at the level. We can see this in the price bars, but also in the moving average that consolidates near the level, then bleeds down through the level as the level fails.

At C, we see a completely different type of price action. First of all, we should have been on alert because price “should not” have been back at the level the next day if it was going to hold. A successful test with price rejection like we had the day before should have led to a series of higher lows as buyers held the market above the level. The next day, we are back at the level and now price goes dull and quiet at the level. We can see this in the price bars, but also in the moving average that consolidates near the level, then bleeds down through the level as the level fails.http://www.smbtraining.com/blog/will-support-hold-or-fail-price-rejection-can-usually-tell-the-tale